Working Capital Solutions for Seasonal and Service-Based Businesses

- Capital Infusion

- Nov 3, 2025

- 4 min read

Keeping your cash flow steady when business isn’t.

The Seasonal Cash Flow Challenge for Small Businesses

Every service-based or blue-collar business has its rhythm. Landscaping crews stay busy through spring and summer, HVAC companies see surges when the weather swings, and construction teams often slow down in the winter months. These natural cycles can make managing cash flow tricky — especially when expenses don’t pause just because revenue dips.

Even steady service providers like cleaning companies, trucking operations, or repair shops feel the impact when customer demand slows or payments lag. Payroll, materials, insurance, and vehicle costs continue to pile up, creating short-term gaps that strain working capital.

That’s why many small business owners turn to working capital solutions for seasonal businesses — flexible funding tools that fill the gap between busy periods and slower months. The right financing option can help cover operating costs, keep staff on payroll, and position your company to ramp up again when demand returns.

Loans Built for Service-Based Companies

Traditional banks often struggle to adapt to the needs of service-based businesses. Their underwriting standards rely heavily on past tax returns and long-term collateral — both of which can be tough to leverage if revenue fluctuates throughout the year.

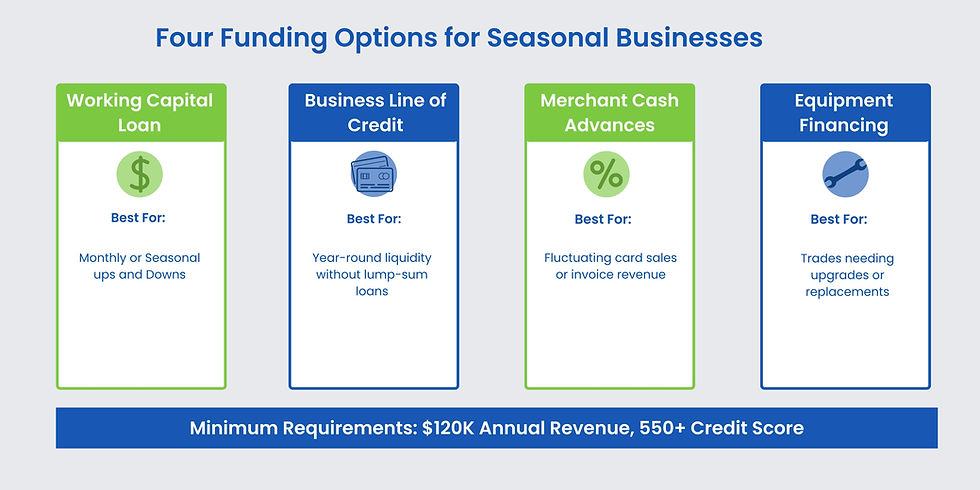

Fortunately, a new generation of alternative lenders and private funding providers understands these realities. They focus on cash flow, deposit patterns, and time in business rather than credit alone. For U.S. businesses with at least $120,000 in annual revenue and a credit score of 550 or higher, these options can unlock fast, practical access to working capital.

Here are some funding tools that fit naturally with the way service-based businesses operate:

1. Working Capital Loans

These short-term working capital loans are designed to help with daily operations and are based on your recent business performance. Approval decisions typically focus on revenue trends rather than personal credit, making them a strong option for business owners in the 550–650 credit range.

Funds can be used for payroll, materials, marketing, or catching up on bills during a slow period. Many lenders offer same-day approvals and funding within 24–48 hours.

Best for: Businesses that experience monthly or seasonal ups and downs but have consistent deposits.

2. Business Lines of Credit

A business line of credit gives you flexible access to funds that you can draw when needed and repay as cash flow improves. You only pay interest on what you use.

This is especially helpful for service providers who deal with unpredictable client schedules — for example, a contractor waiting for a project to start or a cleaning service with fluctuating monthly contracts.

Best for: Businesses that want to maintain liquidity year-round without taking on a lump-sum loan.

3. Merchant Cash Advances

Merchant cash advances (MCAs) provide an upfront sum in exchange for a percentage of future receivables. Since repayment adjusts with your sales volume, MCAs naturally accommodate seasonal slowdowns.

For example, a landscaping business that slows during winter will automatically remit less during those months, avoiding the pressure of fixed payments.

Best for: Businesses with fluctuating card sales or invoice revenue that need quick, flexible funding.

4. Equipment Financing

For many service-based companies, equipment is the backbone of operations — trucks, mowers, tools, or HVAC units. Equipment financing allows you to purchase or upgrade assets while spreading out payments over time.

Because the equipment itself secures the loan, approval is typically easier, and rates can be lower than unsecured options.

Best for: Trades and field-service businesses needing upgrades or replacements without depleting cash reserves.

How Funding Tools Help During Slowdowns

Seasonal slow periods aren’t just an inconvenience — they can limit your ability to grow. When working capital runs tight, opportunities are missed: discounts on supplies, new contracts, or the ability to retain experienced staff.

The right business funding for slow seasons can act as a stabilizer, ensuring your operations stay consistent year-round.

Here’s how:

Sustain payroll and retain talent. Experienced employees are hard to replace. Having funds on hand lets you keep your team through slow months.

Pre-purchase inventory or materials. Stock up when prices are low or when suppliers offer end-of-season deals.

Invest in marketing during the off-season. Advertising when competitors go quiet can help you capture more business once demand rebounds.

Smooth out cash flow gaps. Cover recurring expenses like rent, insurance, and utilities without dipping into personal savings.

Having a dependable financial partner ensures your business isn’t forced into reactive decisions each year — you can plan with confidence.

Flexible Repayment Options and Advisory Support

Another major advantage of alternative funding is flexibility. Many lenders specializing in working capital for seasonal businesses offer repayment schedules that adjust to your business cycle. Daily, weekly, or monthly payment structures can be customized to align with your incoming revenue streams.

Some even provide advisory support, helping business owners forecast seasonal patterns, track cash flow, and choose the right repayment term. This consultative approach turns funding into a partnership rather than a one-time transaction.

When comparing small business loans for service-based companies, look for lenders that provide:

Transparent terms with no hidden fees

Early payoff discounts or renewal incentives

Personalized account management for repeat funding

Digital portals for tracking balances and deposits in real time

These small details make a big difference when managing a company that experiences both busy and quiet seasons.

Final Thoughts: Staying Ready for the Next Season

Every small business owner knows that cash flow timing can be just as important as total revenue. The key is preparation — having a reliable source of working capital that bridges those short gaps without adding long-term debt.

With today’s lending technology, fast approvals, and flexible repayment business loans, service-based entrepreneurs can stay fully operational year-round. Whether you’re gearing up for a busy season or managing a temporary slowdown, the right funding strategy helps you stay confident, consistent, and ready for growth.

Apply Now for Flexible Working Capital

At Capital Infusion, we understand that seasonal business cycles are a normal part of growth. That’s why we help U.S. business owners secure working capital loans for seasonal and service-based businesses — fast, flexible, and tailored to real cash-flow needs.

If your business earns $120,000 or more annually and has at least a 550 credit score, you could qualify for funding in as little as 24 hours. Don’t let seasonal slowdowns hold your business back — keep momentum year-round.

Comments